Filing taxes can be a confusing process for anyone – just watch any of the Turbo Tax commercials on TV. People of all income levels can struggle with filing their returns, but the process can be even worse for people without access to tax services.

That’s where University of Richmond students step in.

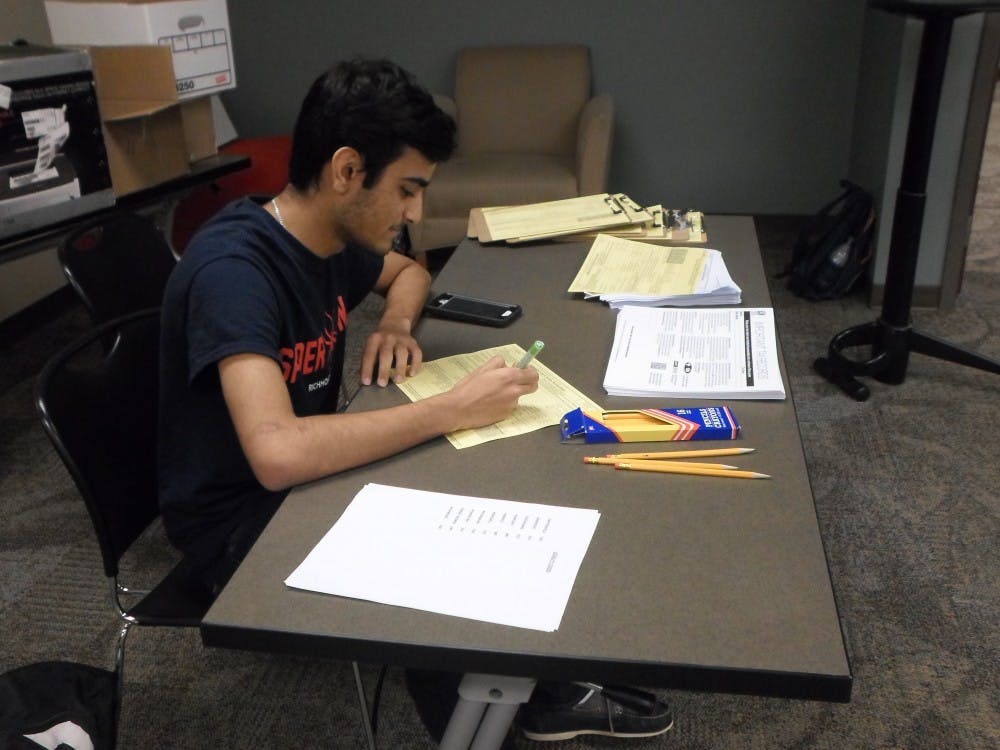

Close to 50 accounting students volunteer with the Volunteer Income Tax Assistance program (VITA), which files taxes for those with moderate to low incomes, free of charge. Though the program is in its fourth year at Richmond, participation is growing and students are close to filing the most returns to date this year.

“I have more students than I have space,” Ray Slaughter, accounting professor and co-founder of Richmond’s VITA program, said. “They love the opportunity to practice working with clients, talking to people and solving people’s problems.”

The IRS created VITA in 1971, but Slaughter and Kimberly Dean, director of UR Downtown, brought the program to the university in 2012. Though the city of Richmond had had the program for 11 years at that point, Slaughter and Dean sensed a need in the Richmond community for more VITA centers. They opened the university’s center at UR Downtown, a university-owned building in the center of the city, and used Slaughter’s accounting students to help prepare taxes, Dean said.

“Our biggest base of volunteers continues to be Richmond students,” Dean said. “Our students are the most dedicated in terms of coming here week after week and getting their hours done.”

As the program participation has increased, so has the number of returns filed. With approximately 170 returns submitted by mid-March, Slaughter said he expected the amount to rise to at least 250 by Tax Day on April 15. Much of the business is due to repeat customers, Dean said.

“We had people showing up here in January saying, ‘I got my taxes done here last year and I really want to get them done here again,’” Dean said. “People vote with their feet. If it’s bad, they’re going to somewhere else.”

Students receive 10 hours of intensive training, including role-playing client scenarios and learning about taxes associated with the Affordable Care Act, and must pass an exam to be certified as tax preparers. They are also required to complete 14 volunteer hours per semester.

“The training actually taught us things that were so complex I never ran into them before,” Robert Nogay, a junior and VITA volunteer, said.

Nogay was overwhelmed his first day on the job, but learned quickly, he said.

“The entire refund process is like a battle to get them the most money,” Nogay said. “They earned their refund, and it became my responsibility to make sure they received it.”

Enjoy what you're reading?

Signup for our newsletter

Slaughter and Dean said they had heard only positive feedback from students about their experiences working at VITA.

“It’s really exciting for students to not only use their skills in a really practical way, but to interact with clients and understand what this kind of service means to them, and what it means to them to get a big refund,” Dean said.

Nogay said he was grateful for the opportunity to volunteer with the program.

“It gave incredible insight into how lucky we are as Richmond students,” Nogay said. “I met people that had trouble reading and writing, and yet I complain about college because I have homework and tests.”

Slaughter said he hoped he was not only preparing students for life as an accountant, but for life as an engaged citizen, too.

“When you see you’ve made an improvement in somebody’s life, when you see that you’ve brought joy into their life, there’s no better feeling,” Slaughter said. “And once you get it, you’ll want to do it all the time.”

Contact features writer Caroline Utz at caroline.utz@richmond.edu

Support independent student media

You can make a tax-deductible donation by clicking the button below, which takes you to our secure PayPal account. The page is set up to receive contributions in whatever amount you designate. We look forward to using the money we raise to further our mission of providing honest and accurate information to students, faculty, staff, alumni and others in the general public.

Donate Now